Being a successful multifamily real estate investor comes with building the right business plan. When it comes to finding a great multifamily investment. It’s important to take into consideration if the asset has a good ‘unit mix’ in order to maximize occupancy and potential tenants.

So what does unit mix mean, and what is the correct unit mix for multifamily real estate properties? Here’s what you need to know about this topic!

What is a Unit Mix?

Unit mix refers to the different number of apartments in an asset. Apartments come in various sizes, ranging from an efficiency apartment, studio’s 1-bedroom apartments, 2-bedroom apartments, and 4 bedroom apartments. The ratio of units is your unit mix. So if you’re buying a complex with 50 two-bedroom apartments and 50 one-bedroom apartments, your unit mix is 1:1. That is, for every two-bedroom apartment, there’s a one-bedroom place.

What is an Efficiency Apartment?

An efficiency apartment is a studio that combines the living, sleeping, and kitchen areas. These units are, in most cases, occupied by a single tenant. The difference between studios v efficiency apartments is the fact that efficiency apartments typically are smaller than studios and have fewer features.

Unit Mix Example in Multifamily Real Estate

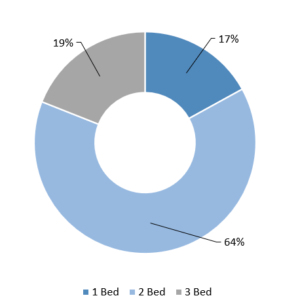

To give you an example of what a unit mix looks like graphically, Please see the image below an example of a unit mix on one of our recently acquired 530 unit multifamily properties:

Why is the “Unit Mix” Important for Multifamily Investors?

Your mix of apartment units will have a significant impact on your building’s occupancy and income potential.

As a simple example, let’s say you have an apartment building in a town with many families. Let’s say there’s an industrial plant nearby, and many families have settled in the area and work at this plant. There are no colleges, no universities, and not a lot of nightlife.

What would you expect the preferred apartment type to be – one or two bedrooms in this town? Since these are families, most complexes will probably find it much easier to rent out two-three-bedroom places than units with a single bedroom.

By understanding your market, you are able to understand what unit mix would make the most sense. Having the optimal unit mix ensures that you can have higher occupancy and a more stable tenant base- meaning more cash flow in your pocket as an investor!

What is an Ideal “Unit Mix” in Apartment Communities?

The question, then, for investors, is what the optimal ratio is? Or, put another way, what type of unit mix is most likely to be the best buy?

The unit mix by size and type should be according to studying the market you are interested in. Unit mix trends are driven by factors such as location, tenant demographics, and the size of the property! Generally speaking, shifting demographics and more families looking to rent long-term means that a good rule of thumb to follow as a multifamily investor is to have 2x more 2-3 bedroom apartment units than one-bedroom units within an apartment community.

For example, in a 300 unit apartment community, at least 200 of those units should be 2-3 bedroom floorplans.

For the average area, this works because the two-bedroom units will typically attract the more stable tenants (and provide space for the one-bedroom tenants to move if they outgrow the single bedroom).

However, this is just a general guide. You should do market research on any unit you are buying to see if this ratio holds or if the building you want to buy is in an area with different demographics. Buying an apartment building with more studios and 1-bedrooms in a place like New York City, for example, might make total financial sense!

Before Making the Investment, Consider the Unit Mix

While there are general rules of thumb when it comes to unit mix, ultimately, this is merely something to know and do due diligence on before signing on the dotted line. If you’re looking to buy an apartment building with a 2:1 ratio, you’re probably on the right track (still do your research!). However, if you’re looking to buy a building with a much different ratio, you should probably understand why this is the case and if it will still be a fantastic investment before making the purchase.

Your complex’s unit mix is one factor of success, but it’s a pretty significant one. Ensure it makes sense for the area before you submit any offers!