Real estate syndications can be a great path to investing in real estate. Part of the reason they are such good investment opportunities is that real estate syndication returns can be pretty significant. If you want to invest in a syndication, here’s the level of investment return you could, hypothetically, receive!

Real Estate Syndication Returns: A Quick Disclaimer

Before getting into what returns syndications can provide, it’s worth noting that all examples in this post are purely hypothetical. Like any form of investing, the adage “past performance does not guarantee future results” applies to syndications. All investing involves the risk of loss, and just because one syndication does well, that doesn’t mean another one will!

Hypothetical Returns

With that in mind, if you would like to invest in a real estate syndication, you should know that excellent returns are possible. Part of the reason syndications make such fantastic investments is that they offer returns consisting of both capital appreciation and passive income. Put another way, the building and land the syndication purchases will likely go up in value. As that value increases, the building will generate rental income from residential or commercial tenants. Couple this will a value add investment strategy and this combination is what can produce some fantastic results.

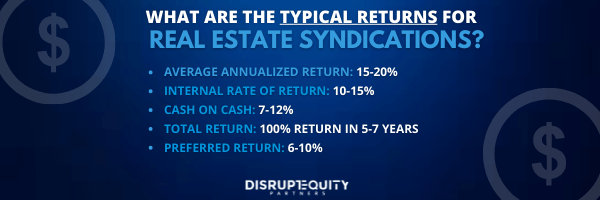

On average here are the average returns you can expect as an investor in a real estate syndication:

- Average annualized return (Your yearly return): 15-20%

- Internal rate of return: 10-15%

- Cash on cash return (The return on your initial cash invested): 7-12%

- Total Return (Your total return once the asset is sold): 100% return in 5-7 years

- Preferred Returns (The return paid to investors first): 6-10% (if offered by your real estate syndication company)

Real Estate Syndication Returns: What You Can Actually Make When Investing

Key Figures:

- Cash on Cash Return: 8%

- Profit on Sale: 45%

- Hold time: 5 years

With all that in mind, suppose you were to invest $200,000 in a real estate syndication today? What could you, hypothetically, expect to receive in the future?

As noted above, the typical hold time for these investments is five years. For this example, let’s assume that is the investment duration.

During that time, investors we’ll typically receive an 8%+ cash-on-cash return (which is the return you get on the cash you initially invested). That means an investment of $200,000 would bring in between $16,000 per year. Over five years, an investor’s cash on cash returns would amount to $80,000.

After the five years is up, the syndication would look to sell the building. At that point, typically, when you factor in the appreciation of the asset and any improvements done to the asset throughout the hold time, a real estate syndication will most likely receive a 45-60% of the profit on the sale.

If we were to model a 45% profit upon sale, this statistic means that investors will get back their $200,000 investment plus $90,000 profits from the sale of the property (not including the $80,000 of cash-on-cash returns received throughout the life of the investment).

Therefore, the hypothetical real estate syndication returns on a $200,000 investment would be $170,000 over five years.

How Do Real Estate Syndications Compare with Other Investments?

To truly appreciate why real estate syndication returns are so attractive, you need to compare them with other investments.

Bank accounts currently pay about 1% in interest, if even that. Leaving that $200,000 in a bank account will give you $10,000 at the end of five years – a far cry from $170,000.

The average stock market returns are about 10% per year. By putting your money in stocks, you could, hypothetically, earn about $100,000 over five years off that $200,000. However, that’s still not as good as the theoretical amounts for our real estate syndication.

Many people also consider investing in REITs either in addition to or instead of syndications. However, even REITs only average between 11.1% and 11.9% returns. While that’s getting much closer to the hypothetical returns of our syndication, it’s still not quite there yet!

Indeed, short of very speculative investments (crypto, perhaps), it’s challenging to find another passive investment that can double over five years!

Real Estate Syndication Returns Are Attractive

While it’s impossible to stress enough that these examples are hypothetical, they show how attractive real estate syndication returns can be. Deals often have the structure above: five-year terms, 8%-10% cash-on-cash, and an expected profit upon sale of about 45%-60+%. That means that investments in syndications have the potential to double over five years. It’s hard to find that elsewhere in the investment world – especially when the underlying asset is as stable as real estate!

Syndications present an attractive, easy, and potentially lucrative way to get into the world of real estate. Indeed, syndications are a fantastic way to diversify your portfolio and provide a stable, passive income stream!