Retirement is a near-universal desire, yet it’s arguably one of the most complex goals for most people to achieve financially. Many Americans are falling short of their retirement goals, with a median average savings level of $107,000 between 55 and 64. At the same time, people are living longer. Thankfully, life expectancy in this nation increases every year due to advances in medical technology. When people think of retirement, they often believe they will need lots of money to fund their current lifestyle, but there is a new emerging trend to be minimalist in terms of retirement. That “minimalist financial independence” is called Lean FIRE. Indeed, this concept and mindset mean that financial independence and retirement are much closer than you think!

What Is Lean FIRE?

FIRE is an acronym that stands for “Financial Independence Retire Early.” When someone talks about strategies for FIRE, they are talking about how to become independently wealthy enough to retire before the age of 60. Those interested in FIRE often retire at 30 or 40 or 50 and desire to live very comfortable lifestyles on their incomes.

Most people would love to retire early. The problem is that it requires significant resources to achieve. Indeed, depending on how early you retire, you could need to be able to live 40-50 years off your investments alone. Unless you have a fantastic job, can save a ton of money, or own and sell a business, it’s tough to make that significant level of capital.

That’s where Lean FIRE can help. This concept is still about achieving independence and retiring early. Instead of looking at your retirement savings to cover everything, though, you look at your investments paying for your necessities. Lean FIRE happens when you have enough money to cover food, transportation, rent, and other essentials.

People who retire early with this minimal passive income often supplement it with active income sources. The difference is that instead of needing to work a job for your basics, the only work you need to do is to buy the things you want. You don’t need to work if you don’t care for that Hawaiian vacation!

Why Would People Choose This Path Of Early Retirement?

At first glance, Lean FIRE seems like a strange concept. Why would someone retire with only enough money to cover the basics? And, if you have to work to pay for anything above the basics, how are you retired?

There are three reasons why Lean FIRE is becoming more popular.

- First, many people want to retire and never work again, but many find themselves bored during retirement, even those who don’t expect it. It might sound fun to golf every day, but anything done too often becomes repetitive. Lean FIRE means your basics are covered, so you never have to work in a job or situation you don’t like. That means you can pick and choose where you work and the hours you work instead of needing to work somewhere you hate to put food on the table. You’re working, but the way you work and when you do so is entirely up to you!

- Second, this concept is appealing from a stability perspective. Something is comforting knowing that you can pay your bills just from your investments. That means if you lose your job, the impact is not devastating to your financial state. The income from your investments will cover the basics, which is a very freeing feeling.

- Lastly, it’s an achievable goal – the first achievable goal, really – in terms of retirement. The amount you need to Lean FIRE is the bare minimum you’ll need if you want to retire before the age of 60! If you’re going to save more, that’s fantastic, but the Lean number is the absolute minimum.

What Is the Amount Necessary to Retire Early the Lean Way?

The amount necessary to Lean FIRE depends heavily on the area. Like New York or Los Angeles, some areas would require significantly more money because your living expenses (i.e., housing, food, transportation) will be much higher in these markets. For example, your dollars will go so much further in Lubbock than Los Angeles!

To determine your Lean FIRE amount, you need to determine your necessary living expenses. Make sure to account for:

- rent

- food

- transportation

- medical

- personal items

- misc.

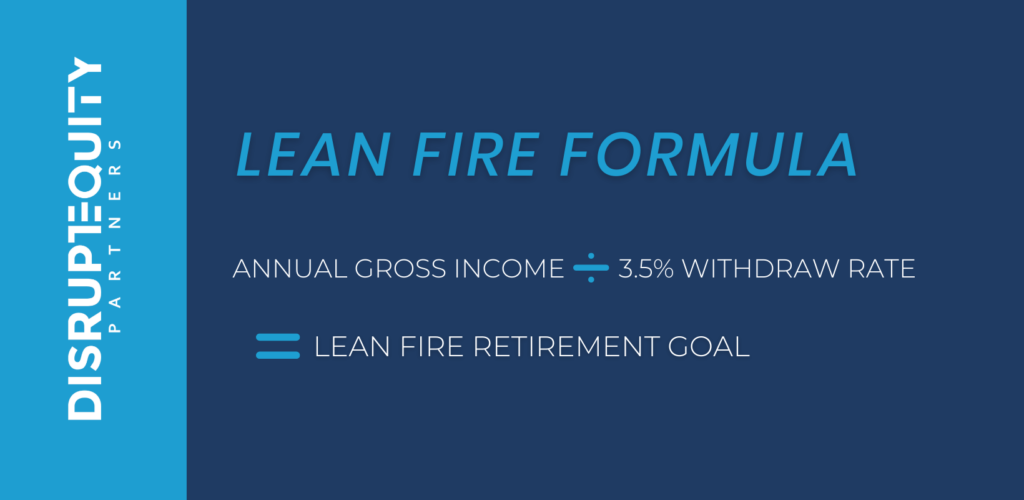

Calculating Your Lean FIRE Goal

To determine your Lean Fire, the goal we will make the following assumptions.

- 3.5% rate of return

- 3.5% withdrawal rate (i.e., the yearly amount you are withdrawing to cover your expenses)

To calculate your Lean FIRE goal, you will determine the annual gross income needed to cover the expenses that you identified above.

In this example, we are going to assume $45,000.

$45,000/.035 = $1,285,714 portfolio size needed to achieve Lean FIRE.

However, keep in mind modeling a 3.5% investor return is very conservative underwriting, and by opting for certain investment vehicles, your Lean Fire portfolio goal can be much more achievable. For example, when investing in multifamily real estate syndications that distribute passive income, on average, investors can expect a minimum of a 7-10% annualized return in today’s market.

Taking this into consideration, to achieve Lean FIRE with a 7% withdrawal rate

$45,000/.07 = $642,857.143 portfolio size needed to achieve Lean FIRE.

Keep in mind; this is not considering that many syndications perform much better than this. For example, at Disrupt Equity, our full-cycle apartment deals have achieved our investors between a 20-50% annualized return. All in all, higher returns will help investors gain a quicker pathway towards Lean FIRE!

Is There a Way to Lean FIRE with Fewer Assets?

The stumbling block most people have when retiring early – even the lean way – is that it’s hard to accumulate the assets necessary to withdraw 3.5% per year and still be ok.

If you have fewer assets, Lean FIRE may still be an option. However, you’ll need to focus on pursuing investments that produce a higher rate of return. While all investments have the potential for loss, real estate has historically been one of the better investments because it can generate quite a bit of cash flow (i.e., passive income), and investors can also take advantage of strong asset appreciation. And as mentioned above, real estate syndications are a fantastic way for individuals to get involved in real estate passively and sustainably grow closer towards their desired Lean FIRE financial goal.

Lean FIRE: Retirement Might Be Closer Than You Think!

If you’re looking to retire early and are willing to embrace the Lean FIRE life, retirement might be a lot closer than you think! Note that most Lean FIRE individuals are not fully retired – many will work part-time jobs. The difference, of course, is that you aren’t working to buy the basics; you’re working to invest in and buy the things that are important for you and your family.

If you want to retire early, calculate your Lean FIRE number. That’s the bare minimum you need to get by.

No matter when you want to retire, whether it’s early or at 65, you’ll need investments that generate great returns on your capital.

Historically the best place to start is Real Estate. If you’re interested in passive real estate investing we recommend you check out our guide: Passive Real Estate Investing: Getting Involved or visit Disrupt Equity’s Investment Page to fill out your information to learn more about investing passively with Disrupt Equity.