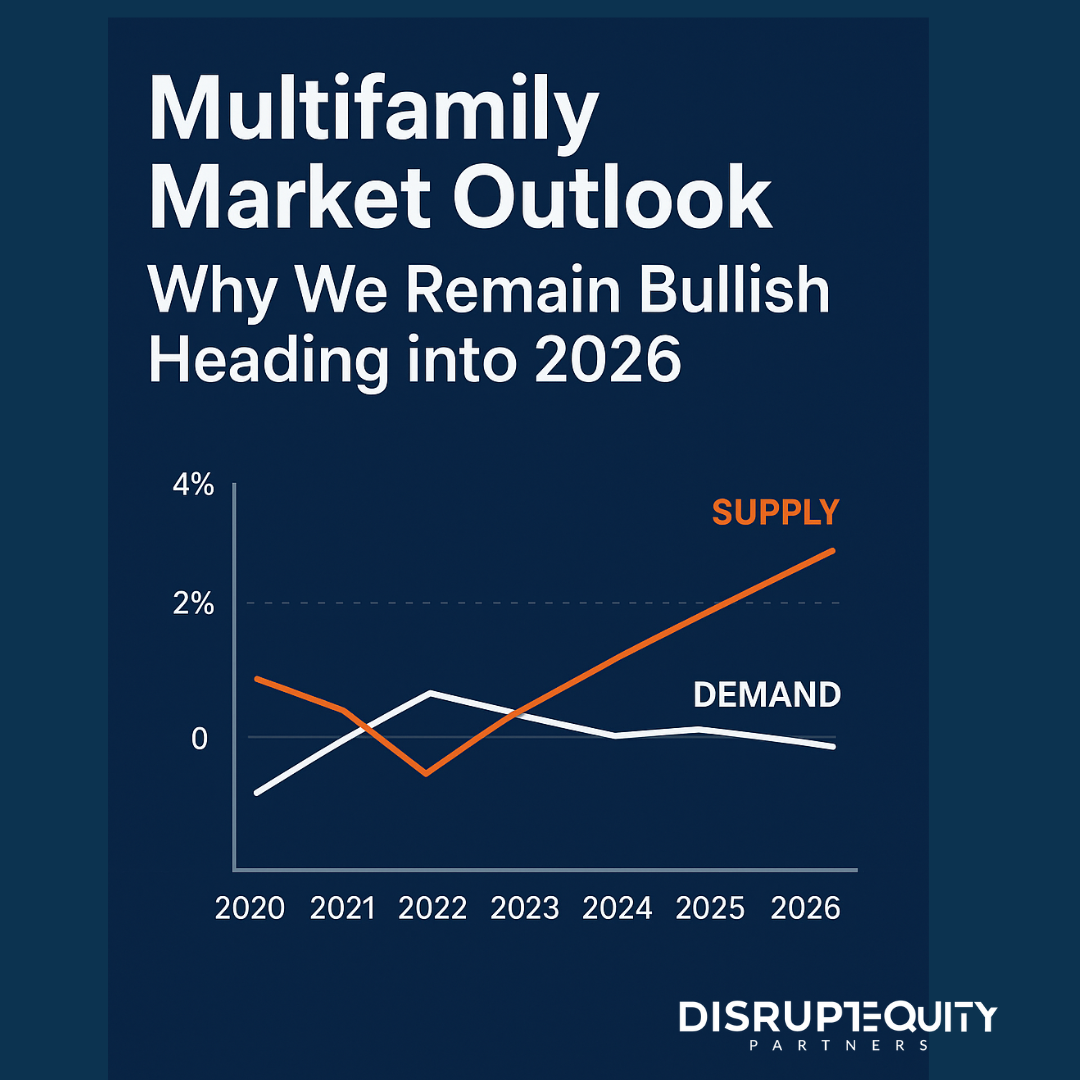

As 2025 comes to a close, the multifamily sector continues to demonstrate resilience despite higher interest rates, inflationary pressures, and tighter lending conditions. While some investors have paused amid uncertainty, Disrupt Equity remains confident in the sector’s long-term strength and the opportunities emerging in this environment. Our perspective going into 2026 is simple: multifamily real…