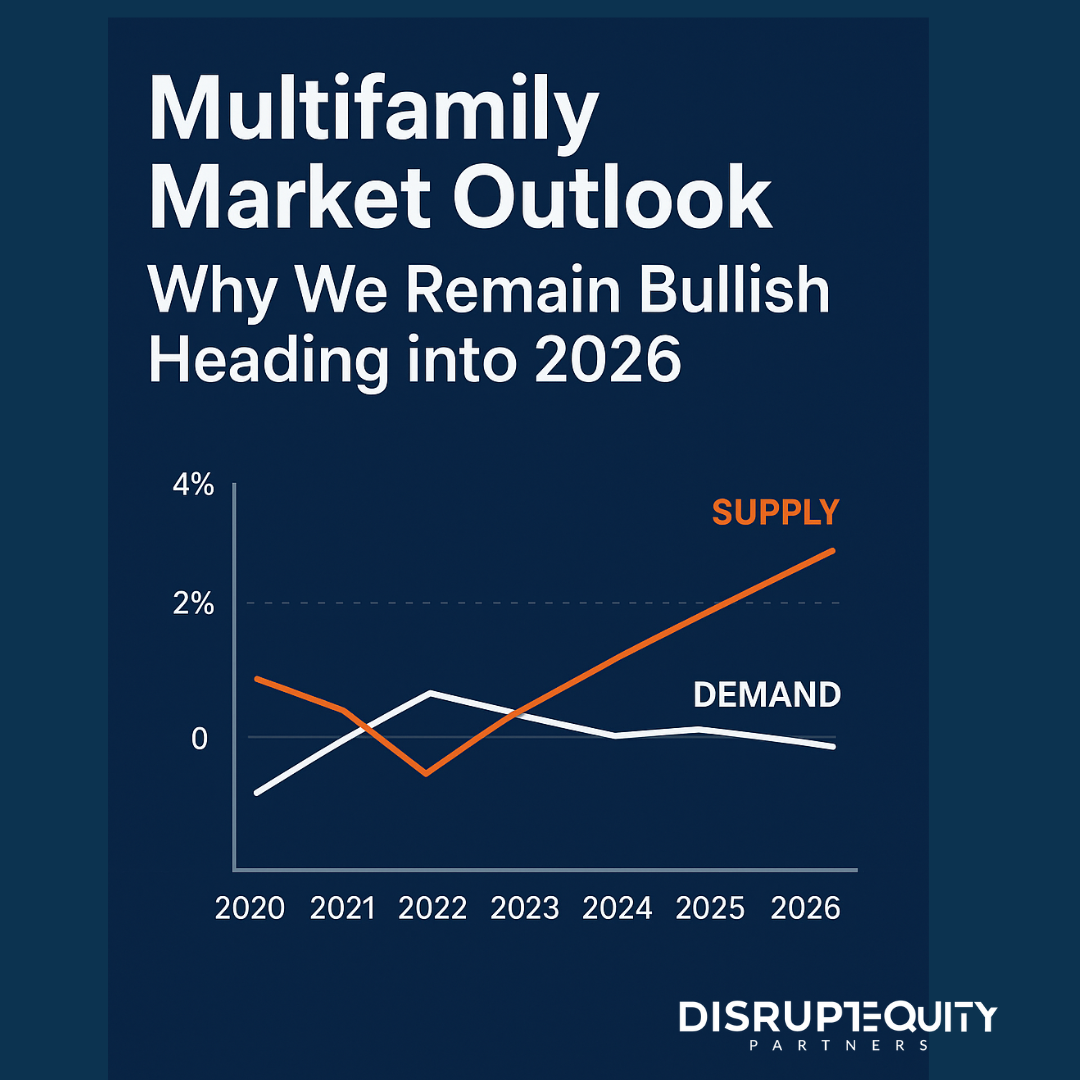

The multifamily market outlook 2026 reflects a sector that has moved through recalibration and into a more balanced phase of the cycle. Conditions today look meaningfully different than they did a year ago. Pricing has adjusted. Underwriting has normalized. Capital now engages with clearer expectations. The market did not reach this point by accident. The…