2023 has been a year of substantial changes in the capital markets, accompanied by a rapid surge in interest rates. The multifamily sector experienced a decline in volume, with a $30.1 billion decrease and a -12.8% price change in Q3. Commercial and multifamily mortgage loan originations were also significantly lower compared to the previous year, showing a 49% decrease in the third quarter (source: Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations).

While multifamily rent growth has decelerated from the soaring highs of the past years, it still remains positive. Moody’s Analytics CRE reports that the average asking rent in the U.S. has increased by 2.2% year over year. However, this growth rate is lower than the 11.1% reported a year ago, marking the lowest since 2021. The vacancy rate, though slightly higher than in 2022, remains near historical lows at 5.1% (source: Moody’s Analytics CRE).

As the capital markets have encountered significant disruptions and a rapid surge in interest rates in 2023, property owners have been placed in a tough position. They have been confronted with the challenging decision of either injecting substantial new capital into their holdings or choosing to sell their assets.

The convergence of rising interest rates, economic uncertainty, capital calls, and paused distributions has had a profound impact on investor behavior. Consequently, many investors have been apprehensive and have temporarily halted their real estate investment activities throughout 2023.

A Look Into Multifamily Investing In 2024

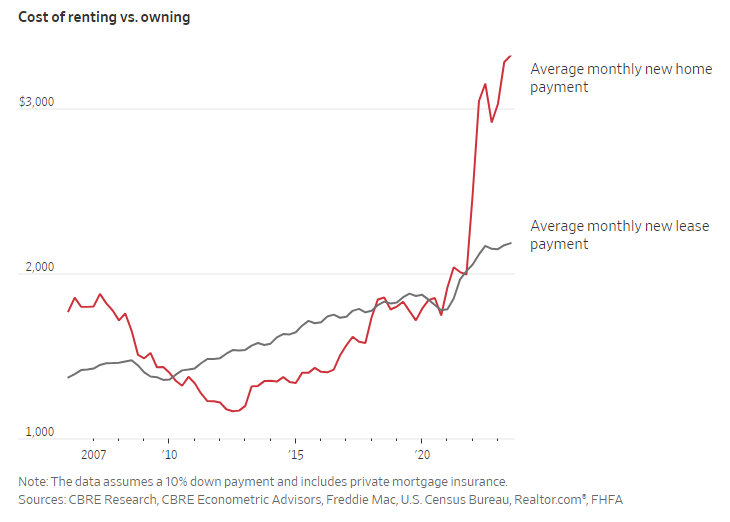

Despite the challenges faced in the market, we remain confident that multifamily investing continues to be favorable as we look ahead to 2024. There are several reasons for this optimism. Firstly, the demand for rental properties in the U.S. remains healthy, as reflected by the consistently low vacancy rates throughout 2023. The rising mortgage rates for single-family homes, reaching around 7%, have made homeownership unattainable for many in the middle class. As you can see from the chart below – the cost between renting and owning became insurmountable in 2023.

Source WSJ read article

Furthermore, since the Federal Reserve initiated rate hikes in March 2022, the affordability of homes has significantly changed. Previously, an individual with a $2,000 monthly budget could comfortably afford a home worth over $400,000. However, with interest rates hovering around 7% now, that same buyer would need to search for a home valued at $295,000 or less. This scenario is further compounded by a longstanding shortage of low-income housing, which has plagued the housing market for decades. Consequently, there is a substantial and rapidly increasing demand for multifamily apartment properties and residential rentals, which is expected to remain throughout 2024.

In conjunction with strong demand, we believe that numerous advantageous opportunities for strong operators will emerge throughout 2024. Owners who took on variable rate debt in recent years are now grappling with interest rates that have doubled or even tripled, increased reserve requirements, and a sharp decrease in operating cash flow. As more owners face upcoming debt maturities or the need to rebalance their loans with limited options for refinancing due to restricted liquidity, well-capitalized owners have a chance to swoop in and acquire these assets under extremely favorable conditions. Many of these properties are well-built in prime locations and will be entering the market not because of any inherent issues with the real estate itself, but rather due to the current constraints on liquidity and the significant costs associated with near-term debt obligations.

At Disrupt Equity, we firmly believe that 2024 will be the year to acquire high-performing assets in sought-after locations at significant discounts. There’s never been a better time for investors to collaborate with ownership groups that possess a proven track record, extensive industry relationships, and expertise in identifying strategic investment opportunities.

Our vigilant Acquisitions Team at Disrupt Equity is on the lookout for strong opportunities both on and off market. Our focus lies on assets located in Houston, Austin, Dallas, San Antonio, Tampa, Orlando, Jacksonville, Atlanta, Charlotte, Raleigh/Durham, Nashville, Columbus, Indianapolis, and Phoenix. These markets boast a business-friendly, tax-friendly, and landlord-friendly climate, positioning them to benefit from robust population growth, corporate relocations, and job diversity. And not only will these markets experience sustained economic growth throughout 2024, but they are also poised for long-term prosperity.

Final Words To Multifamily Investors

Despite the challenges posed by the current debt market, there are promising investment opportunities on the horizon for multifamily investors in 2024. The multifamily real estate sector has proven its resilience and long-term appreciation potential over the years. As the population continues to grow and lifestyle preferences evolve, coupled with the increasing unaffordability of homeownership, the demand for rental properties is expected to remain strong.

Overall, multifamily real estate stands out as a recession-resilient asset class. By partnering with the right operators, and capitalizing on the stability and long-term growth potential of multifamily, investors can position themselves to preserve and expand their wealth, even in times of economic uncertainty.

If you’re not already an investor with Disrupt Equity, we’d love the opportunity to earn your trust and become your partner in the upcoming year. If you’re interested in joining our investor list, you can sign up right here.